STANDARD INTERCHANGE PLUS PRICING

Merchant pays processing fees. No line-item fee shown to customer.

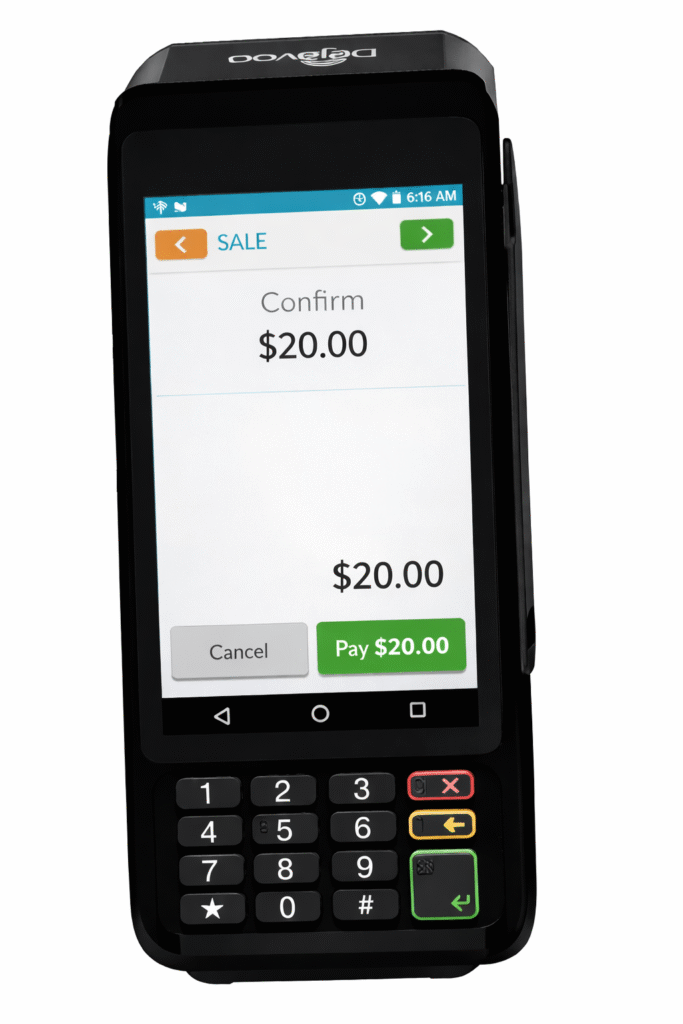

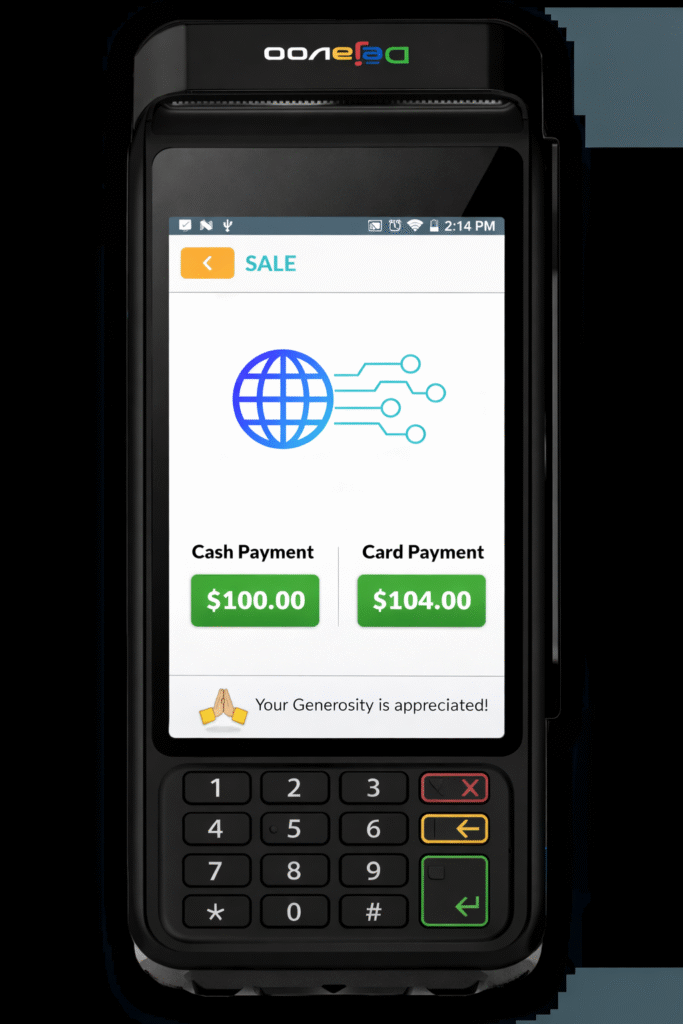

DUAL PRICING

Cash price shown.

Card price includes processing cost — merchant pays $0 in card fees.

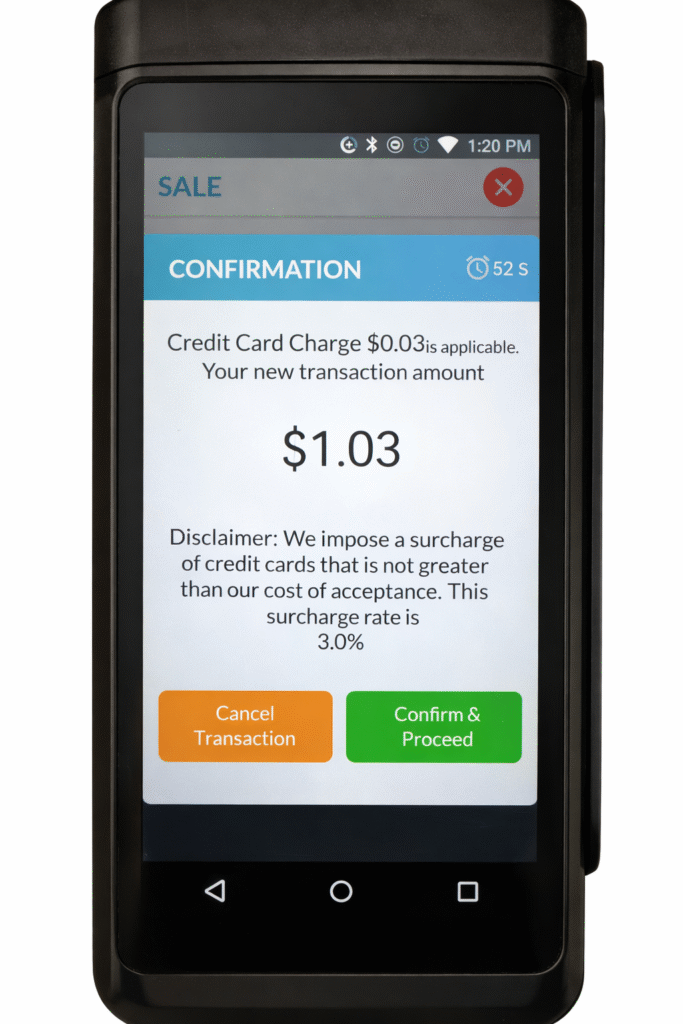

SURCHARGING

Cardholder pays a compliant credit card surcharge.

Debit is fee-free and fees are paid by the merchant.

All three models are compliant. The right choice depends on ticket size, customer behavior and margin goals.

IC+PRICING

IC+ pricing is the most transparent way to process cards.

You pay the actual interchange cost set by Visa and Mastercard, plus a small negotiated markup.

There are no blended rates, padded percentages, or hidden margins.

WHY IC+ PRICING WORKS(AND IT ISN’T COMPLICATED)

Interchange-plus pricing sounds technical, but in practice it’s the simplest and most honest model.

You see exactly what you’re paying, why you’re paying it, and where every dollar goes.

- One transparent rate: interchange + a fixed markup

- No padded percentages or blended averages

- Statements that clearly show cost vs markup

- Easy to audit, easy to compare, easy to trust

INTERCHANGE PLUS PRICING EXPLAINED

Flat-rate pricing simplifies billing — at the cost of paying premium markup on transactions that don’t deserve it.

Most businesses choose a fixed percentage because it feels predictable. The trade-off is that you end up paying the same inflated rate on every transaction — including low-cost debit cards that are significantly cheaper to process.

IC+ pricing removes that distortion.

With interchange-plus, you pay the actual interchange cost set by Visa and Mastercard for each transaction, plus a small, negotiated markup.

There are:

- No blended rates

- No padded percentages

- No hidden margins

Each transaction is priced based on what it actually costs to run.

A simple way to think about IC+ pricing

Flat-rate pricing is essentially tiered pricing with only one tier.

IC+ pricing works the same way — except instead of forcing every transaction into a single averaged rate, it allows for as many tiers as needed:

- Lower-cost debit cards price lower

- Standard credit cards price appropriately

- Premium and rewards cards cost more — as they should

You’re no longer subsidizing expensive cards with cheap ones.

Flat rates aren’t designed to save you money — they’re designed to protect margins across every card type.

IC+ pricing is best suited for businesses with higher ticket sizes, mixed card usage, or owners who want transparency and long-term cost control instead of convenience pricing.

DUAL PRICING (CASH DISCOUNT)

Dual pricing eliminates merchant processing fees by adjusting how prices are presented.

Prices are displayed at a card-inclusive amount. Customers paying with cash or debit receive a discount, while credit card transactions cover their own processing cost.

There is no line-item “fee” added at checkout. That would be a surcharge. Dual pricing is a pricing model — not a penalty.

WHY MERCHANTS CHOOSE DUAL PRICING

- Merchant pays $0 in credit card processing fees

- Immediate margin improvement (typically 2-3%)

- Customers choose how they want to pay

- Cash usage increases naturally

- Clean checkout with no added “fees”

What about customer pushback?

In practice, meaningful pushback is rare — and when it happens, the math overwhelmingly favors the merchant.

A business processing $1,000,000 per year typically pays $20,000–$30,000 in card processing fees.

To be worse off under dual pricing, that business would need to lose $20,000–$30,000 in net profit — not gross sales — which simply doesn’t happen.

Surcharging doesn’t maximize margin — it minimizes resistance.

For merchants worried about negative customer feedback, this is often the safest middle ground, giving price-sensitive customers a no-fee debit card option.

Still Deciding Which Pricing Model Makes Sense?

There isn’t a universal “best” option. The right pricing model depends on how you sell, what your customers expect, and how much friction you’re willing to tolerate.

I’m happy to walk through it with you before you change anything.