With the expansion of big tech in all our lives, really smart people that tweak the algorithm, design the app or analyze the data are cool these days.

Yeah, these people …

Dudes back in the day that stuffed nerds in lockers are looking to increase their equity in startups run by Founders and CTOs who embrace complexity and look to Bill Gates as a role model instead of a swashbuckling Wolf of Wall Street.

When it comes to credit card processing, complexity in the form of variable or interchange-plus pricing can be an advantage.

What Is Interchange-Plus Credit Card Processing?

Interchange is the fee the card holder’s bank charges to extend credit to your customer paying for goods and services. There are considerable risks involved. Ever know anyone to get behind on their credit card bills? Who eats that? The bank does. To compensate, they charge interchange to businesses and interest to their customers to cover this risk.

Interchange differs from your effective rate, the total fee you are charged for payment processing divided by your total credit card sales.

Interchange-plus pricing is when a credit card processor charges different rates for different types of credit cards.

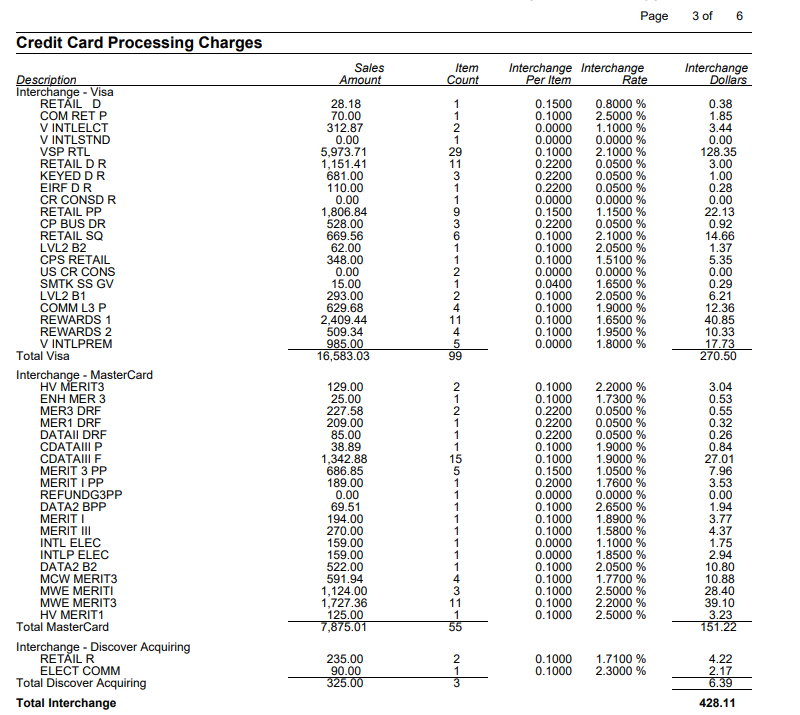

Many payment processors tout “one flat rate” of 2.9%. Let’s take a look at a sample statement showing the varying interchange fees for Visa, MasterCard and Discover:

As we discussed here, card processors can lure you with a seemingly fixed rate that is essentially variable. You expect this and get something entirely different when you open up your card statement.

Interchange Plus vs. Fixed Credit Card Processing

Some card processers specialize in a vertical like law or accounting. They promise a simple fee like 1.95% + $0.20 for debit cards and the major brand credit cards (Visa, MasterCard and Discover).

Sounds simple and reasonable, right?

But, as we asked before, do you really know your effective rate? They offer 1.9%, but there is the “bump” to 2.9% if you take certain types of cards. Which ones? Where is the transparency or cutoff?

A 2.9% interchange rate is the ceiling for most credit cards and does not include any qualifiers or bumps into tiered pricing. Some companies may qualify for a lower “introduction” rate of 1.5%. Most of these bait-and-switch intro rates have variable or tiered pricing for certain cards.

What about debit cards? As you can see above, some debit cards cost 0.05%

Is 2.9% fair? Is 1.9% fair?

Interchange-Plus Payment Processing Benefits

There’s a better way. Interchange-plus or cost-plus pricing is where a credit card processor charges you exactly what they’re charged plus a negotiated markup based on your business.

Your statement is easy to read, and you know exactly what you’re being charged.

As card processing consultants, Ethical Pay Pro offers our customers a 24/7 portal and easy-to-read statements like the one above where the interchange rate is spelled out clearly in its own column per transaction.

When Complex Is Better

A fixed credit card processing rate looks attractive, but once all the qualifiers are thrown in, you can end up with a mess where it is difficult to know exactly what real interchange rate you are paying.

Wouldn’t you rather budget for 2.9% interchange for one month and others pay 2.2% or even 1.6%?

In other words, when the final interchange costs are determined, you’ll save more on a variable rate that is clearly laid out than a fixed rate with obtuse qualifiers hidden in legalese.

Variability might be more complex, but, if presented cleanly, might be the way to go.

Credit card processing, like anything, can be complex. We’re here to nerd out the details and make it more understandable. If you would to explore the slide ruler in our pocket protector, tap here for a free consultation.