Gateway prompts enhanced data entry for Visa CEDP and Level 3 qualification

What is Level 2 and 3 Processing and Why Do I Care?

Card networks charge lower interchange rates when merchants submit enhanced transaction data on commercial, corporate, and purchasing cards. This additional data helps issuers evaluate business spending and reduce fraud risk. In exchange for structured, line-item level detail, the networks apply lower interchange categories.

Translation: When a business takes a payment from another business or government entity and the use a business card, purchasing card, or government card and additional information is sent along with the card number and expiration date, the business can save up to 30%

Rough estimate is around $5000-$10000 per million processed.

Why Do Networks Offer Lower Interchange?

Commercial card programs generate high average tickets and strong repayment performance. When merchants submit enhanced data, issuers receive structured reporting information. In exchange, the networks assign transactions to preferred commercial interchange categories that are often 30 to 90 basis points lower than standard commercial rates.

What Changed with Visa CEDP?

For years, merchants could qualify for Level 2 and Level 3 interchange by submitting the required enhanced data fields. In practice, many systems auto-populated fields or submitted repetitive values simply to meet minimum formatting requirements.

Visa’s Commercial Enhanced Data Program (CEDP) changed that model.

Instead of rewarding the presence of fields alone, Visa now validates the accuracy, consistency, and completeness of enhanced data before assigning preferred commercial interchange categories.

If the data does not meet validation standards, the transaction may downgrade to a higher commercial rate.

This shift reflects a broader capability change. With improved data analytics, networks can now evaluate enhanced data at scale and distinguish between structured, meaningful line-item detail and placeholder values.

Why This Matters

On meaningful volume, the difference is significant.

Example:

$3,000,000 in qualifying commercial volume

0.80% effective interchange improvement

≈ $24,000 annual savings

At $10,000,000+ in commercial, purchasing, or government card volume, merchants can see savings in the $80,000 to $100,000 range depending on mix.

This type of savings materially affects margin.

The Practical Challenge

Enhanced data does not enter itself.

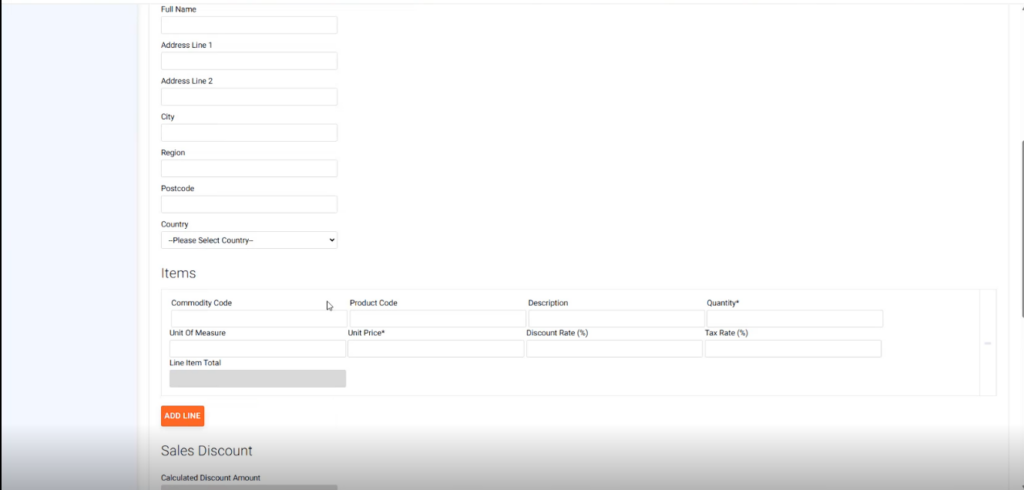

To qualify for reduced interchange, these transactions require:

- Commodity codes

- Line-item detail

- Tax breakdown

- Freight and duty amounts

- Customer reference fields

Cardholders will not provide this information during checkout. In most environments, the burden falls on the merchant.

Manually entering data for every eligible transaction can feel operationally heavy. However, when volume reaches scale, the savings justify the process.

At higher transaction levels, the interchange improvement can offset the cost of dedicated staff member focused solely on manually entering the required data.

The Two Real Options

- Accept higher commercial interchange rates

- Implement a system that identifies eligible transactions and captures required enhanced data before settlement

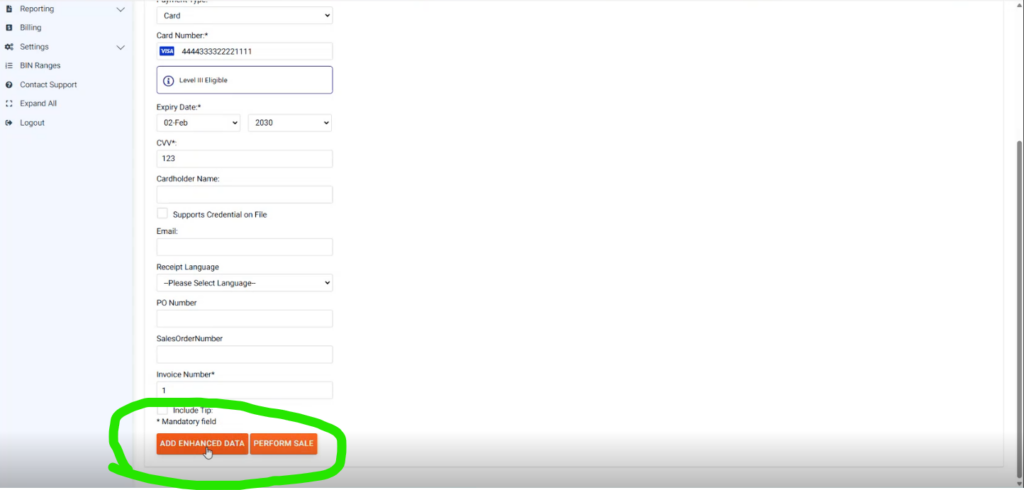

Our gateway takes the second approach.

It flags transactions that qualify and gives merchants the opportunity to enter validated data before final submission.

This ensures that transactions meet current network standards rather than relying on outdated auto population of said data.