Is your payment processor giving you a sack of coal instead of Ralphie’s supercool Red Ryder BB Gun?

You don’t have to be familiar with a holiday classic to identify with expecting one thing and getting something entirely different.

Red Ryder Widgets

Let’s use a hypothetical e-commerce company that ships widgets. They believe their total fee to process credit and debit card transactions or interchange rate is 1.7%

In a year, they process $1 million in total transactions.

They’re expecting the payment processor to remove $17,000 from their sales. They get surprised when the interchange rate is 3.7% or $37k out of the coffers.

No Red Ryder BB guns for the widget company!

What Is Your Effective Rate?

Many people come to us confident they are paying a super low fixed rate for the cost of processing their debit and credit card transactions.

They may even remember the day they strutted into their bank and signed an ironclad contract guaranteeing a 1.7% rate “for qualified transactions.” Some are supremely confident they aren’t getting grifted:

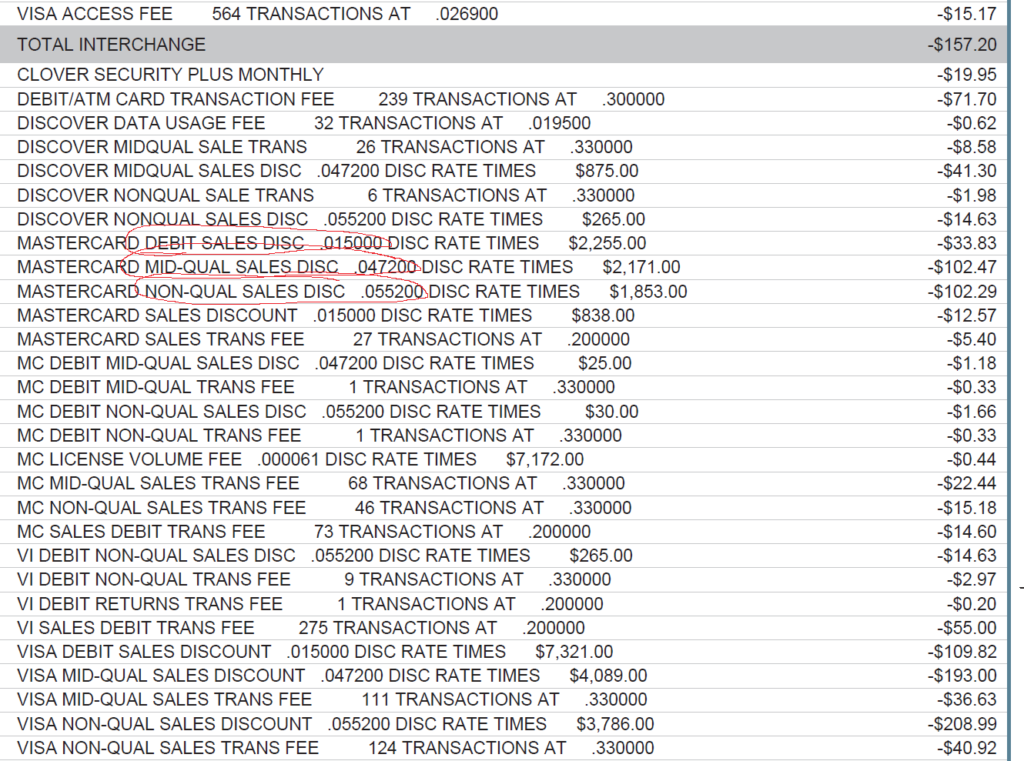

Before we concur, good sir, that there are no shenanigans here, we advise looking closely at another client’s monthly statement:

This client thought he was paying a 1.5% fixed rate. Notice the transactions marked above as “mid-qualifying” and “non-qualifying” rates that are 4.472% and 5.52% respectively.

A bill of goods purportedly at a fixed rate is actually tiered pricing with variable credit card processing rates depending on qualifiers.

Do You Really Know Your Effective Rate?

Your effective interchange rate is simple:

Total Fees / Total Sales

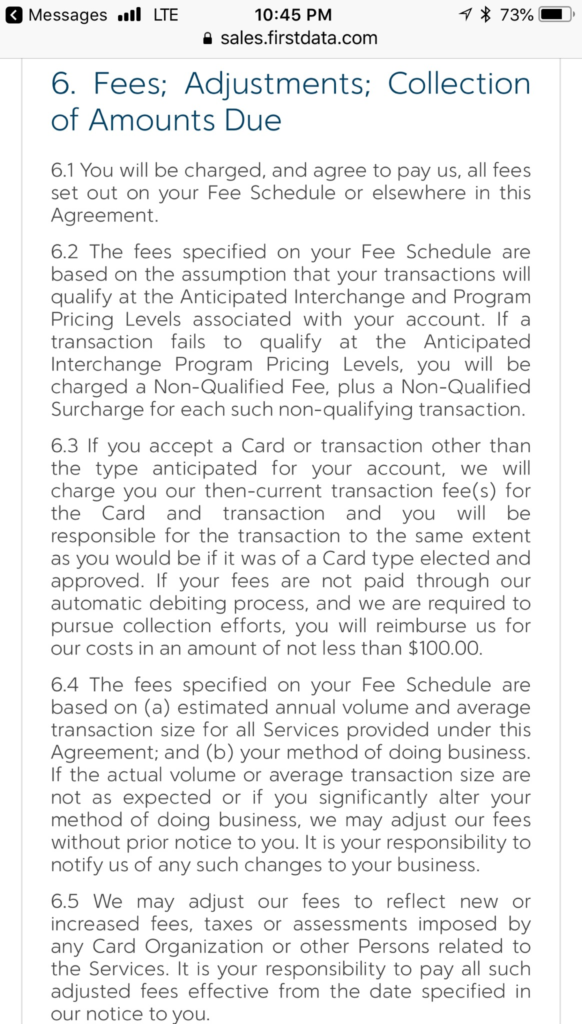

If you are certain that you’re not getting tiered pricing, have you actually read the fine print on your contract?

DO NOT READ the above UNLESS you are a law student or suffering from insomnia.

We will reduce all the dry legalese to this key statement: “The fees …. are based on the assumption [our bold] that your transactions will qualify at …”

Essentially, the processor is stating that the fees are variable, conditional and NOT fixed.

A More Extreme Example

Way back when I was green, my first customer swore to me on his mother’s grave that he was paying a fixed interchange rate of 1.7%. After carefully examining his processor statement, we confirmed he was paying 1.7% on qualifying transactions. He was also paying 6.5% on NON-QUALIFYING transactions.

The processor determines the varying rates by complex series of factors like method of card entry, data quality, ticket size, industry, merchant category card (MCC) and others.

Credit cards cost between 1 and 4% to process. Credit cards with an interchange cost of 1.3% were billed at 1.7% for this client.

Other credit cards with an interchange cost of 2% were being billed at 6.5%!

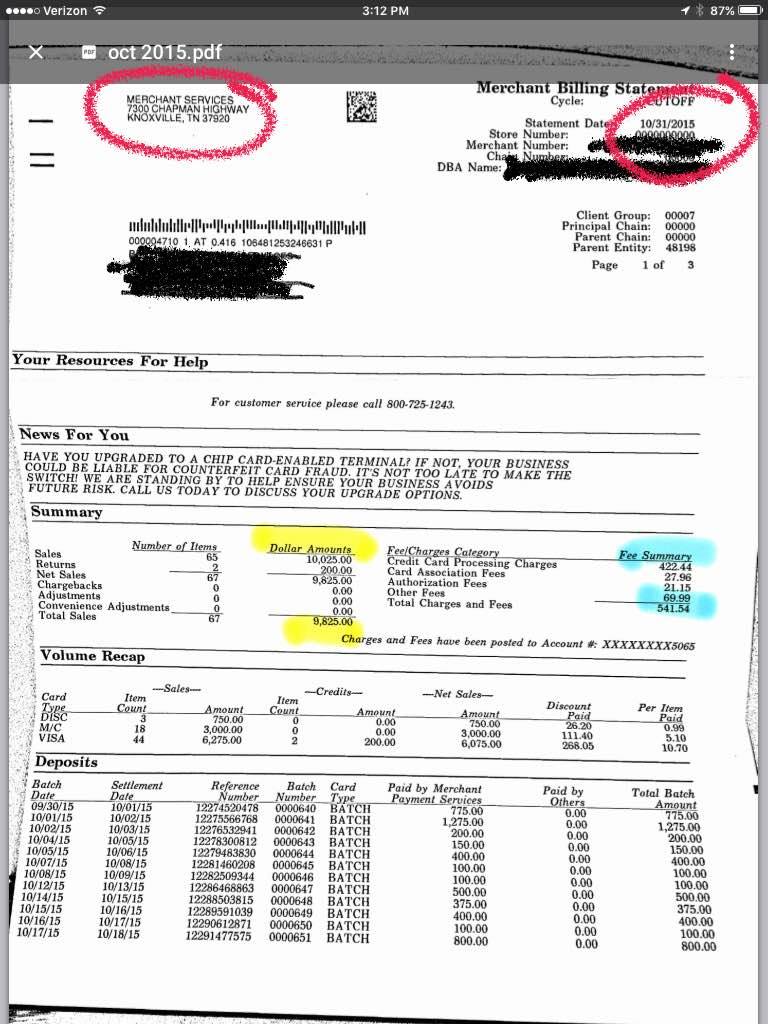

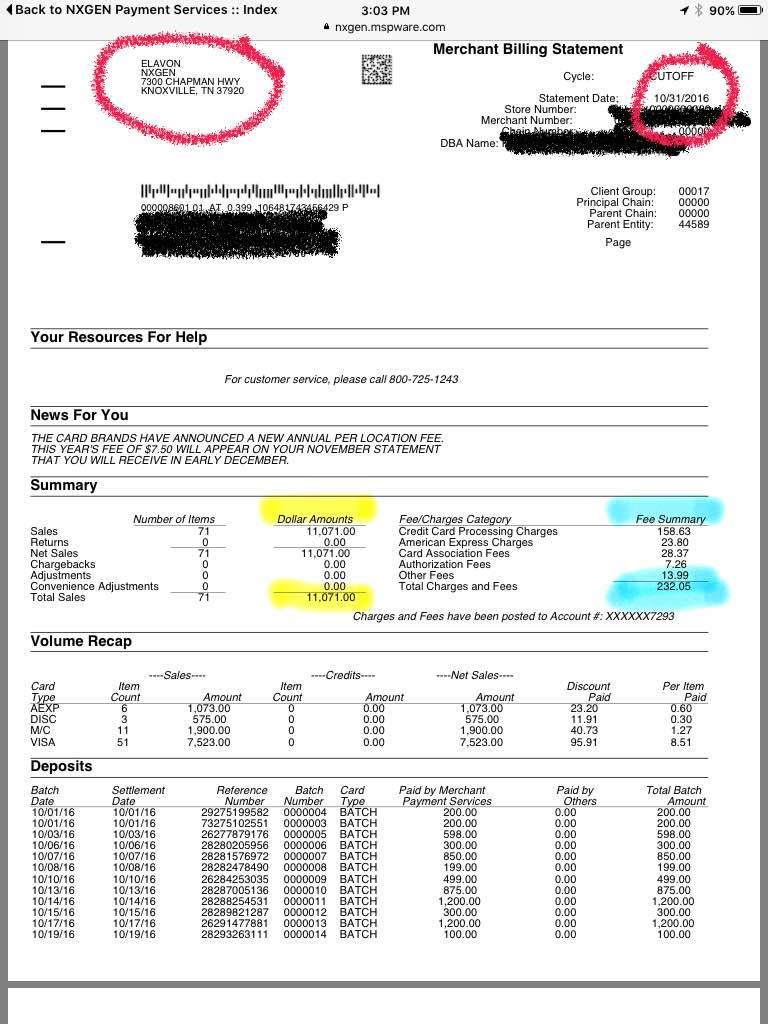

This was a statement when I first started working with him:

The effective rate is 5.5%

This is a statement after I had worked for this client for a year:

The effective rate is 2.1% I had saved this small business owner nearly 62% on payment processing fees!

This is an extreme example. Consider this though: if you were being charged more than what you expected, would you know where to look?

Bait-and-Switch

What exactly is a bait-and-switch con?

Bait-and-switch is a form of fraud used in retail sales but also employed in other contexts. First, customers are “baited” by merchants’ advertising products or services at a low price, but when customers visit the store, they discover that the advertised goods are not available, or the customers are pressured by salespeople to consider similar, but higher-priced items (“switching”).

Wikipedia

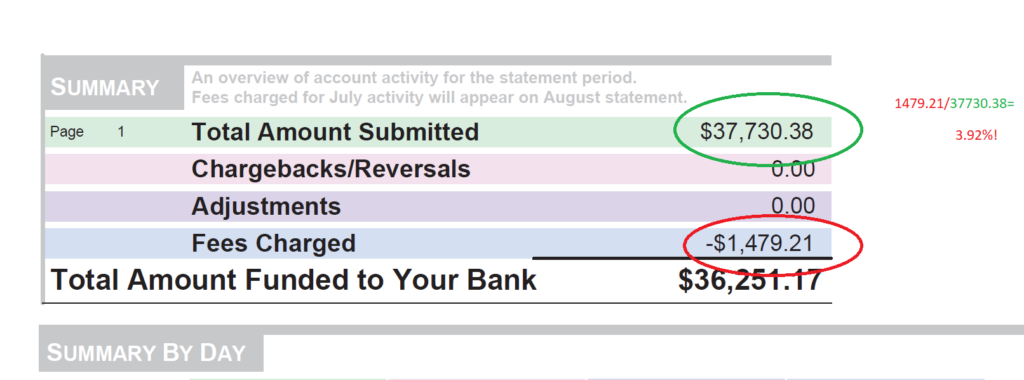

Suppose a small business owner was confident that they were paying an interchange rate of 2.69%.

Upon examination of the statement:

Simple math tells us their real effective rate is 3.92%

Lure ‘em in with a super low rate and then bill at higher, variable rates defined in dry, obtuse contractual language buried in labyrinthine e-communication.

Hmmm, this sounds like a ….

Daily vs. Monthly Discounting

In addition to a seeming “fixed” rate that is actually tiered pricing, processors screw the little guy with daily vs. monthly discounting.

Some processors take fees out daily, making it more difficult to reconcile how much a SMB is paying overall. If you make one sale each day, you might benefit from knowing how much the processor is taking a bite out of your earnings.

If, like most small businesses, you make more than one sale per day, the confusing daily discounting muddles the overall fee picture.

Do You Understand Your Medical Bills?

Have you ever had medical expense and were perplexed why you ended up paying thousands of dollars for a simple medical procedure that is far lower in any other country that doesn’t pay the most on healthcare only to receive the worst care?

You request said medical bill and the obtuse coding and obscure language don’t exactly shed any light.

Credit card processing statements are similarly opaque.

If you are absolutely confident that you are paying a simple interchange rate and there are no “adjustment” clauses in your contract or the end-of-month emails you received and never read, don’t consult with a payment processing consultant like Ethical Pay Pro.

If you want the Red Ryder BB gun you expected and welcome a review of your processing statements semi-regularly to make sure Santa delivers, tap here for a free consultation.